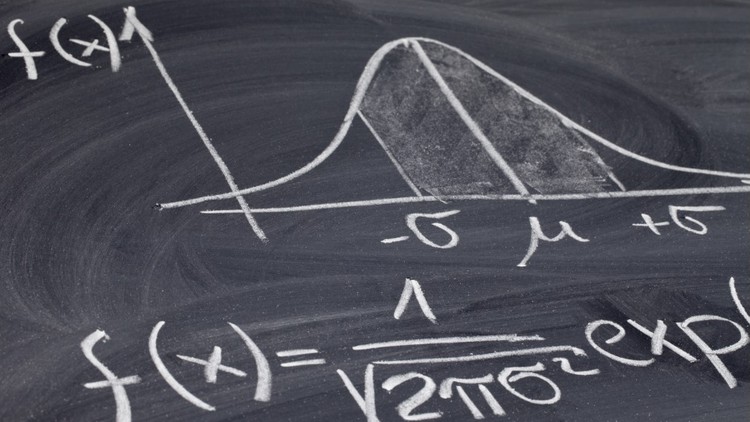

The problem of derivatives pricing is central in the financial industry and the most used technique to determine the price of these products since the early seventies has been Risk-Neutral Pricing. Usage of this technique can be traced back to the XX century in Bachelier’s studies, however, it was not fully understood until the 1970, when financial economists developed a rigorous mathematical framework and linked it to the concept of no-arbitrage. In this post I will try to present a very intuitive explanation of how this technique works and provide some examples that allow to understand the justification of its use.

Gambling with a coin

We will use as toy example a market of derivatives writen on the outcome of a single fair coin toss, with P(Head)=P(Tail)=1/2. Our derivative will be a contract such that you will earn 60€ if the coin turns Head and 0€ if the coin turns Tail; how much would you be willing to pay to play this game? A risk-neutral individual, who does not care about uncertainty, would say 30€, which is the expected gain from the game. However most of the people is risk averse and prefers 30€ in their hands than 30€ in expected gain, so their willingness to pay may be lower than 30€, say 20€. In this setup, the risk neutral probability measure Q is just the weighting of the events (Head and Tail) probabilities that would make the contract give an expected profit equal to the willingness to pay of the players (20€), in this case Q(Head)=1/3, and Q(Tail)=2/3.

The Fundamental Theorems of Asset Pricing

At first sight, the risk neutral probability measure seems an artificial and not very useful construct, but by linking it to the concepts of replication and no-arbitrage, the Fundamental Theorems of Asset Pricing (FTAP) make the Risk-Neutral measure the cornerstone of derivatives pricing. An informal statement of the first theorem would be as follows:

FTAP 1: There exists at least one (equivalent) risk neutral measure such that the price of all assets is given by its discounted expected payoff if and only if there are no arbitraje oportunities in the market.

For a rigorous statement and proof of this result, I refer to the work of S.Ross in the 70s, (Ross 1976 in particular). In this post I will just try to illustrate the relation between the existence of a Risk-Neutral measure and arbitrage oportunities through the following example. Consider now a market with the following contracts on the outcome of our fair coin:

| Derivative1 | Derivative2 | Derivative3 | |

| Payoff | +3€ if heads, +1€ if tails | +3€ if heads, +0€ if tails | +0€ if heads, +1€ if tails |

| Market Price | 2€ | 1.5€ | 0.25€ |

If all three contracts are tradeable, given this prices, there exists an arbitraje oportunity as Derivative1’s payoff can be replicated by Derivative2 + Derivative3 paying a lower price. As there is an arbitrage oportunity, the first FTAP doesn’t apply. In fact, we cannot find a risk neutral measure consistent with all market prices:

•The risk-neutral measure Q1 implied by the price of Derivative1 is characterized by: Q({head}) = 0.5, Q({tail}) = 0.5

•Under Q1, the price of Derivative2 is 1.5€, but the price of Derivative3 is 0.5€

•The risk-neutral measure Q3 implied by the price of Derivative3 is characterized by: Q({head}) = 0.75, Q({tail}) = 0.25€

•Under Q3, the price of Derivative1 is 2.5€

The second important result relates to the uniqueness of such risk-neutral measure.

FTAP 2: There exists a unique (equivalent) risk neutral measure such that the price of all assets is given by its discounted expected payoff if and only if there are no arbitraje opportunities and the market is complete.

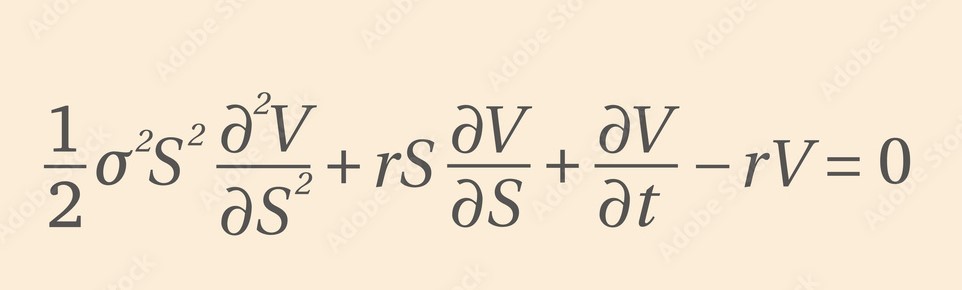

The implications of this theorem are huge. If we know the risk-neutral measure, we can price all the derivatives just by computing its expected payoff. This fact almost begs for a pricing algorithm that can be succintly stated as:

- Assume a stochastic process under the risk-neutral measure.

- Calibrate (choose) the parameters of the process such that you price vanilla products consistently with the available market prices. (We are implicitly assigning risk neutral probabilities to the events of the underlying)

- Price the product of interest by computing its discounted expected payoff. (this may require numerical methods if there is no close form solution for the expectation).

Even though the result of the theorem is powerful, the complete markets assumption is strong and one may be concerned about the price identification in practical applications. In this regard, I will make two comments:

- The deviations from the completeness assumption in modern financial markets can be argued to be small.

- FTAP 2 is a sufficient condition for identification of the risk-neutral measure and hence the price, but it is not necessary for price identification.

In future posts I will develop on some of the intuitions presented on this one.